In the financial sector, an IPO GMP, or Initial Public Offering Grey Market Premium. What is IPO? marks a company’s transition from private to public ownership. This includes issuing shares to the general public for the first time, attracting investors eager to be part of the company’s growth. Understanding IPO is important for investors, as it opens the door to concepts like IPO GMP (IPO Grey Market Premium). The IPO GMP, or IPO Gray Market Premium, refers to the difference between the gray market price of the shares and the IPO issue price. As we delve deeper into this comprehensive guide, we’ll highlight the importance of IPO GMP and how it shapes investment decisions.

What is IPO?

An IPO, or initial public offering, is a financial event where a privately held company trades by issuing shares to the public. It plays an important role in the financial markets, reflecting the company’s decision to raise capital and expand its ownership base. Companies often choose IPOs to raise funds for growth initiatives, debt repayments, or acquisitions. The process involves complex steps starting from the selection of underwriters, financial institutions facilitating the IPO. Next, the company files a prospectus with regulatory authorities detailing its financial health and future prospects. Investors, willing to participate in the company’s journey, then buy shares at the IPO price.

Correlation between IPO and Gray Market Premium (GMP) is significant. GMP represents the premium at which shares are traded in the secondary market before they are officially listed. GMP Dynamics provides investors with insight into market sentiment, providing a preview of potential inventory post price movements. Thus, understanding the basics of IPO lays the foundation for a nuanced understanding of factors such as IPO GMP and its wider implications in the financial landscape.

Understanding IPO GMP

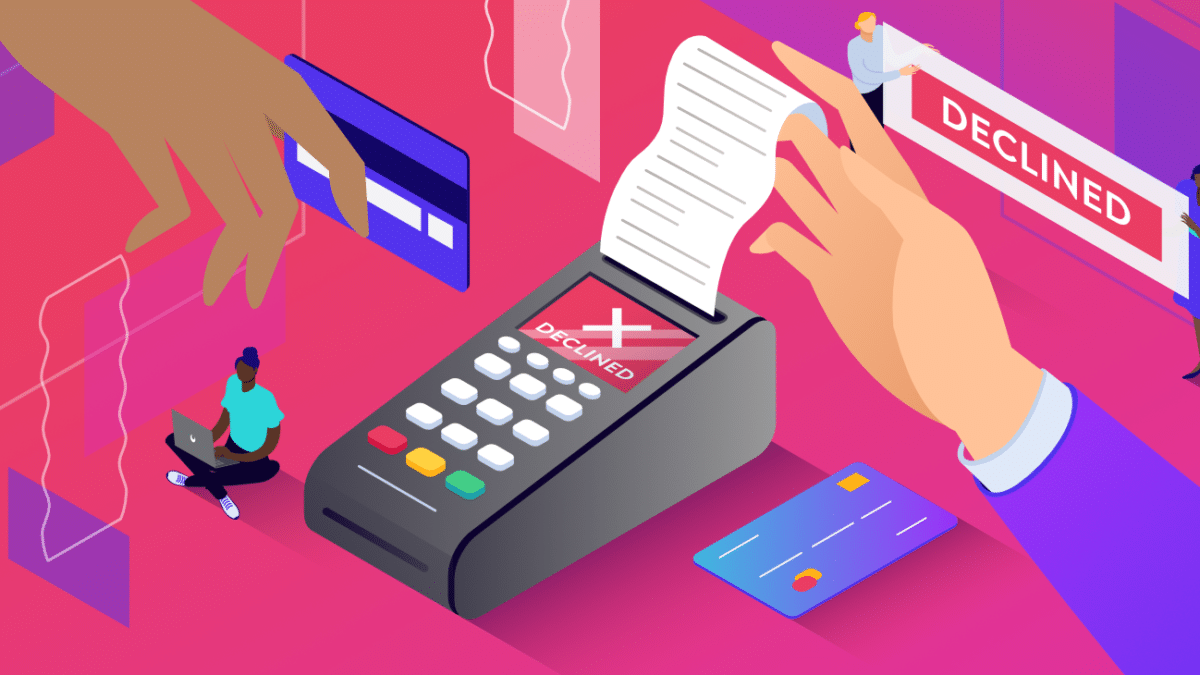

The IPO GMP, or gray market premium, includes the difference between the market price of the IPO share and the actual issue price in the informal secondary market. It provides investors with an important snapshot of market sentiment before the shares are officially listed on the stock exchange. GMP is calculated by subtracting the IPO issue price from the gray market price. A positive GMP indicates a premium, indicating high demand and positive sentiment, while a negative GMP indicates the opposite.

The importance of GMP for investors is profound. It acts as an early indicator, which informs the market’s expectations about the stock’s performance after listing. A high GMP may represent investor interest and short-term profit potential, but it also carries risk if the premium is not sustainable. Conversely, a low or negative GMP can indicate caution and prompt investors to reevaluate their investment strategy. Understanding IPO GMPs enables investors to make informed decisions, balancing the excitement of a new listing with a realistic assessment of market dynamics, ultimately contributing to more strategic and informed investment choices.

If you want to know how stock market works and how to invest in Indian Stock Market then click here, you will get easy and better information.

Why IPO Gray Market Price Matters for Investors

IPOs are very important for GMP investors due to their impact on market dynamics and investor sentiment. A high GMP indicates a premium on the secondary market, indicating strong demand and positive expectations for the stock. Investors may perceive this as a short-term profit opportunity, but caution is required as extremely high premiums can lead to volatility and potential correction after listing.

Conversely, a low or negative GMP may indicate less demand and caution among investors. This may indicate a potential buying opportunity, but it may also indicate concern about the company’s prospects or broader market conditions.

Investors seeking initial public offerings often use GMP as a leading indicator of market sentiment. Monitoring GMP trends on platforms like National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) provides insight into the current market mood. Understanding these dynamics can help investors align their strategies accordingly, either by taking advantage of positive sentiment or exercising caution when in doubt. Ultimately, understanding the implications of GMP enables investors to make more informed decisions while balancing potential returns with risk management in the dynamic landscape of new listings.

Want more content like this? Click Here.

quos et cumque aperiam pariatur assumenda sed aut voluptate ipsam quaerat. placeat sint qui temporibus rerum ab autem animi ut in sit consequuntur excepturi est quis ut recusandae. in harum aut dolore

Wow, this post has given me useful info and answered some of my questions. I hope to give something back and aid others like you helped me. Feel free to surf my website Webemail24 about SEO.