Nifty 50 stock list in 2024 is the best performers stocks of top 50 Blue-chip companies on the Nations Stock Exchange (NSE) based on their Indian market capitalization. Nifty 50 is one of the best Indian benchmark index with 50 top stocks. It contains 50 NSE listed companies with average weightage. Basically Nifty 50 Index is mixture of two terms: Nifty means National Stock Exchange, and other is 50 which is collection of top 50 best preforming stocks in National Stock Exchange.

Nifty 50 can be used for various preposes like ETFs, structured products, launching index funds and benchmarking fund portfolios. Nifty 50 computed in totally four currencies namely Indian Rupees (INR), US Dollar (USD), Canadian Dollar (CAD) and Australian Dollar (AUD). We will discuss list of nifty 50 stocks in detailed in this article.

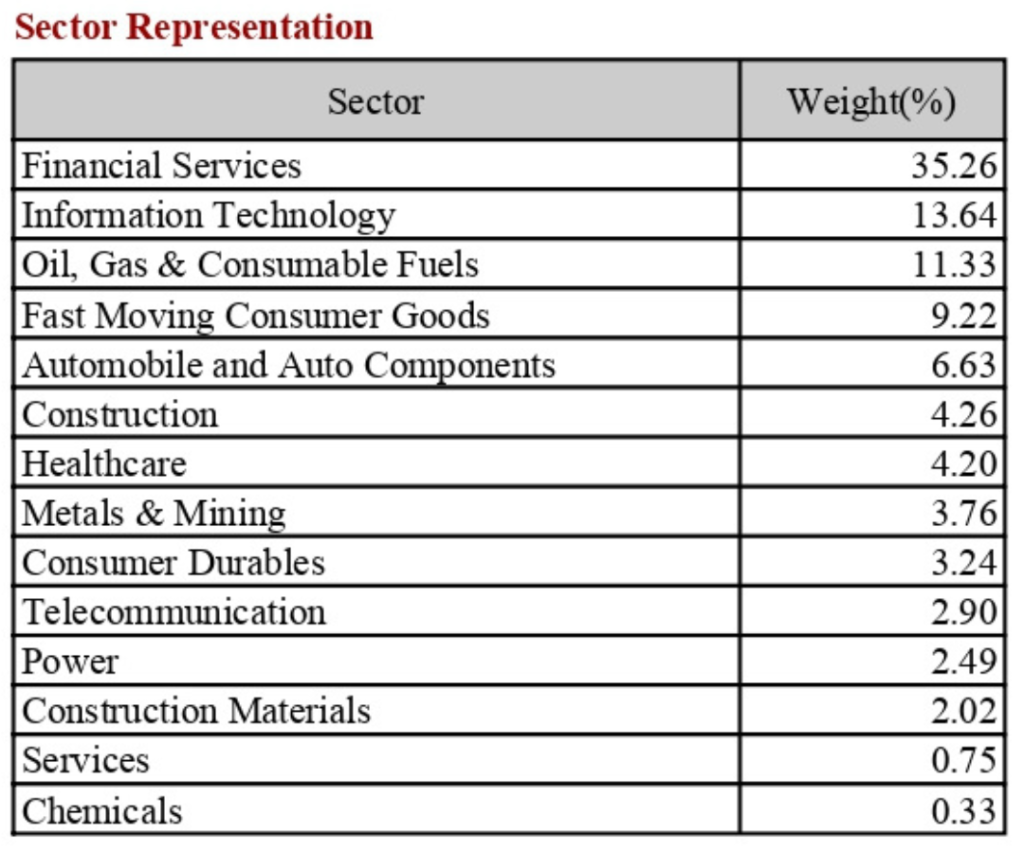

Nifty 50 Sector Weightage

The Nifty 50 Index has a weightage of highest 35.26% to the Financial Services sector, on second no. with 13.64% to the IT sector, 11.33% to the Energy sector which is on third rank, 9.22% to the Consumer Goods sector on fourth rank, 6.63% to Automobiles sector on fifth rank, and 4.26% to the Construction sector on sixth rank. After this on seventh rank with 4.2% Healthcare sector. the weightage of NIFTY 50 sectors keeps changing on the basis of their performance of their stocks. That makes NIFTY 50 index free-floating market capitalization index.

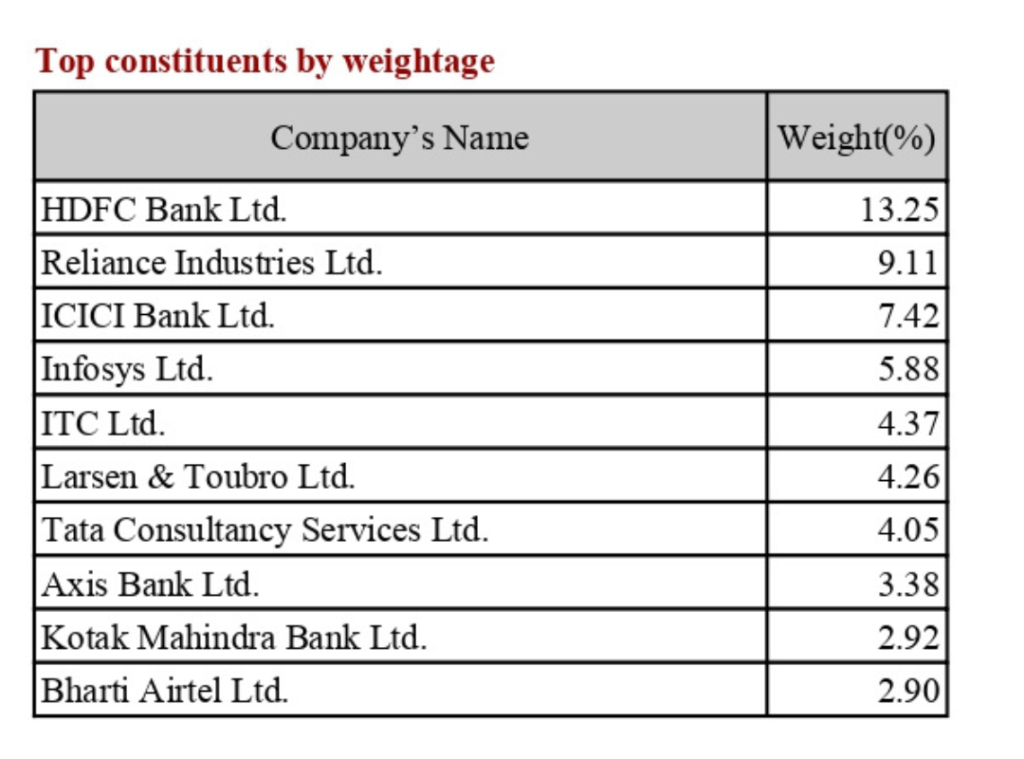

Nifty 50 Companies Weightage: 2024

The NIFTY 50 Index gives highest a weightage of 13.25% to HDFC Bank Ltd. following Reliance Industries Ltd. with 9.11%. On third with 7.11% ICICI Bank Ltd.

Nifty 50 Stock List in 2024: Nifty Stock Weightage 2024

| COMPANY NAME | STOCK SYMBOL | SECTOR | WEIGHTAGE (%) |

| HDFC Bank Ltd. | HDFCBANK | Financial Services | 13.25 |

| Reliance Industries Ltd. | RELIANCE | Oil Gas & Consumable Fuels | 9.11 |

| ICICI Bank Ltd. | ICICIBANK | Financial Services | 7.42 |

| Infosys Ltd. | INFY | Information Technology | 5.88 |

| ITC Ltd. | ITC | Fast Moving Consumer Goods | 4.37 |

| Larsen & Toubro Ltd. | LT | Construction | 4.26 |

| Tata Consultancy Services Ltd. | TCS | Information Technology | 4.05 |

| Axis Bank Ltd. | AXISBANK | Financial Services | 3.38 |

| Kotak Mahindra Bank Ltd. | KOTAKBANK | Financial Services | 2.92 |

| Bharti Airtel Ltd. | BHARTIARTL | Telecommunication | 2.90 |

| Hindustan Unilever Ltd. | HINDUNILVR | Fast Moving Consumer Goods | 2.57 |

| State Bank of India | SBIN | Financial Services | 2.46 |

| Bajaj Finance Ltd. | BAJFINANCE | Financial Services | 2.15 |

| Mahindra & Mahindra Ltd. | M&M | Automobile and Auto Components | 1.67 |

| Asian Paints Ltd. | ASIANPAINT | Consumer Durables | 1.65 |

| HCL Technologies Ltd. | HCLTECH | Information Technology | 1.61 |

| Maruti Suzuki India Ltd. | MARUTI | Automobile and Auto Components | 1.60 |

| Titan Company Ltd. | TITAN | Consumer Durables | 1.59 |

| Sun Pharmaceutical Industries Ltd. | SUNPHARMA | Healthcare | 1.50 |

| NTPC Ltd. | NTPC | Power | 1.41 |

| Tata Motors Ltd. | TATAMOTORS | Automobile and Auto Components | 1.41 |

| UltraTech Cement Ltd. | ULTRACEMCO | Construction Materials | 1.18 |

| Tata Steel Ltd. | TATASTEEL | Metals & Mining | 1.18 |

| IndusInd Bank Ltd. | INDUSINDBK | Financial Services | 1.08 |

| Power Grid Corporation of India Ltd. | POWERGRID | Power | 1.08 |

| Bajaj Finserv Ltd. | BAJAJFINSV | Financial Services | 1.03 |

| Nestle India Ltd. | NESTLEIND | Fast Moving Consumer Goods | 0.98 |

| Adani Enterprises Ltd. | ADANIENT | Metals & Mining | 0.88 |

| Coal India Ltd. | COALINDIA | Oil Gas & Consumable Fuels | 0.88 |

| Oil & Natural Gas Corporation Ltd. | ONGC | Oil Gas & Consumable Fuels | 0.86 |

| Tech Mahindra Ltd. | TECHM | Information Technology | 0.86 |

| Hindalco Industries Ltd. | HINDALCO | Metals & Mining | 0.85 |

| Grasim Industries Ltd. | GRASIM | Construction Materials | 0.84 |

| JSW Steel Ltd. | JSWSTEEL | Metals & Mining | 0.84 |

| HDFC Life Insurance Company Ltd. | HDFCLIFE | Financial Services | 0.84 |

| Dr. Reddy’s Laboratories Ltd. | DRREDDY | Healthcare | 0.80 |

| Bajaj Auto Ltd. | BAJAJ-AUTO | Automobile and Auto Components | 0.78 |

| Adani Ports and Special Economic Zone Ltd. | ADANIPORTS | Services | 0.75 |

| SBI Life Insurance Company Ltd. | SBILIFE | Financial Services | 0.73 |

| Cipla Ltd. | CIPLA | Healthcare | 0.72 |

| Wipro Ltd. | WIPRO | Information Technology | 0.66 |

| Britannia Industries Ltd. | BRITANNIA | Fast Moving Consumer Goods | 0.65 |

| Tata Consumer Products Ltd. | TATACONSUM | Fast Moving Consumer Goods | 0.64 |

| Apollo Hospitals Enterprise Ltd. | APOLLOHOSP | Healthcare | 0.63 |

| Eicher Motors Ltd. | EICHERMOT | Automobile and Auto Components | 0.60 |

| LTIMindtree | LTIM | Information Technology | 0.58 |

| Hero MotoCorp Ltd. | HEROMOTOCO | Automobile and Auto Components | 0.56 |

| Divi’s Laboratories Ltd. | DIVISLAB | Healthcare | 0.55 |

| Bharat Petroleum Corporation Ltd. | BPCL | Oil Gas & Consumable Fuels | 0.47 |

| UPL Ltd. | UPL | Chemicals | 0.33 |

Read Also: IPO GMP & IPO Grey Market Premium

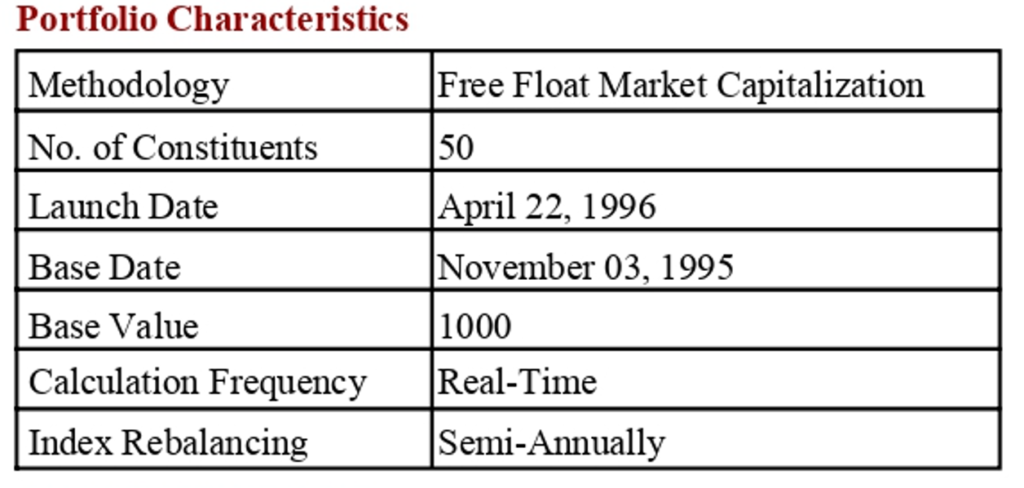

Top Nifty 50 Companies List 2024: Selection Criteria

To check which stocks will be in the list of Nifty 50 stocks, a set of criteria and guidelines need to be followed. The following criteria is used to decide which company will be in the Nifty 50 list:

Nifty 50 Stocks: Liquidity

“Nifty 50 Stocks: Liquidity” emphasizes that Nifty 50 index constituents can be bought or sold in the market without significantly affecting their prices. Liquidity is an important factor for investors, which ensures profitable trading and minimum price fall. High liquidity in Nifty 50 stocks means that large volumes can be traded with minimal impact on market prices, giving investors flexibility and confidence. Liquidity is associated with widely traded and popular stocks in the Nifty 50, which increases market efficiency and allows investors to easily enter or exit positions for more stable and attractive investments. Contributes to the environment.

Top Nifty 50 Companies: How to Invest in Them?

Invest Directly into stocks individually

Everyone can directly invest into Nifty 50 index stocks using some stock brokers if capital is available. To invest in Nifty 50 constituents investor need to invest approximately INR 1.9 lakhs and not every retail investors have that money to invest or purchase one share from the Nifty 50 list. Also managing 50 stocks is very difficult.

Invest through Mutual Fund

To invest in Nifty 50 stocks is to pick mutual funds that invest the pool money into Nifty 50. Also one can start investing minimum SIP in mutual funds that tracks Nifty 50 companies win minimum INR 500. SIP investment can also done in Lumpsum mode.

Read Also: How to Start Investing in the Stock Market in India.

Nifty F&O trading (Future and Options)

Investors with limited capital can start invest/trade in Future and Option in Nifty 50 index in between 9.15 AM to 3.30 PM. But due to high leverage and lack of knowledge in F&O sector, investors makes loss.

Nifty 50 Stocks: Float-Adjusted Market Capitalization

The list of 50 stocks in NSE are determined by their free float market capitalization. Free float market cap is calculated using their Multiplying its own stock price by the total number of shares available in the market for the Nifty 50 stocks.

Example: If XYZ company has 20,000 shares in free float and the price of each stock is INR 100, Then the companies Free float market cap is INR 20 Lakh (20,000*100).

Companies will be eligible for inclusion in Nifty 50 index list with average free float market capitalization is at least 1.5 times the average free float market capitalization of the smallest constituent in the index.

Nifty 50 Stocks: Trading Frequency

100% should be the company’s trading frequency in the last six months.

Nifty 50 Companies List 2024: Futures & Options segment

Their are some limited companies that are permitted to trade in the F&O segment and eligible to be included in the Nifty 50 stock list.

Nifty 50 Stocks: Newly-listed Stock

Nifty 50 company listed stock should have at least listing history of 6 months. If some company files for an IPO, then they will be eligible for inclusion in Nifty 50 index only of they meets the normal eligibility criteria for the index for 3 months rather than 6 months. This criteria is only for IPO listed and the listing history remains 6 months for other listing options such as demergers and takeovers.

Happy Investing!

1 thought on “Nifty 50 Stock List in 2024: Important Stocks”